The Guardian Service

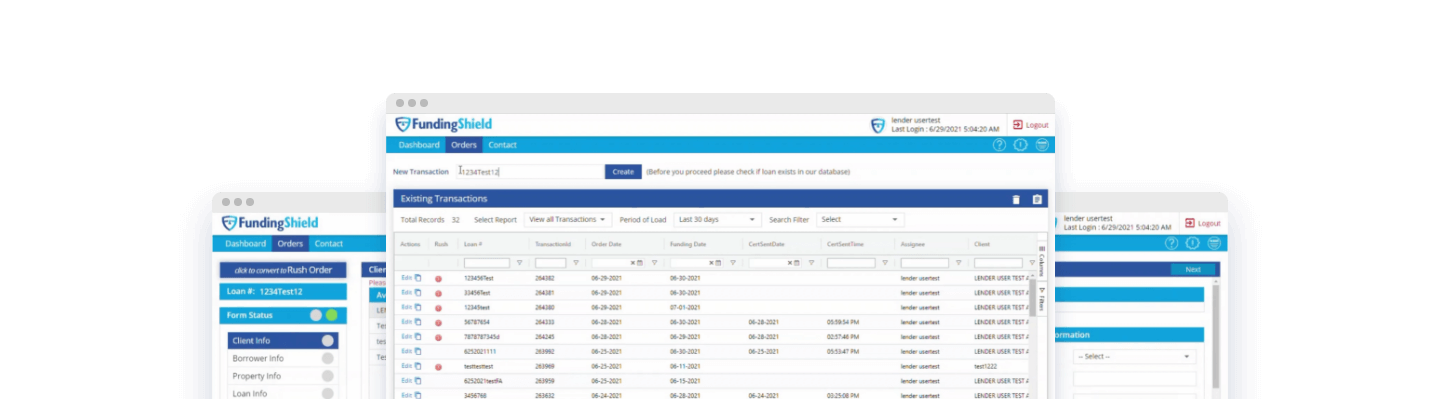

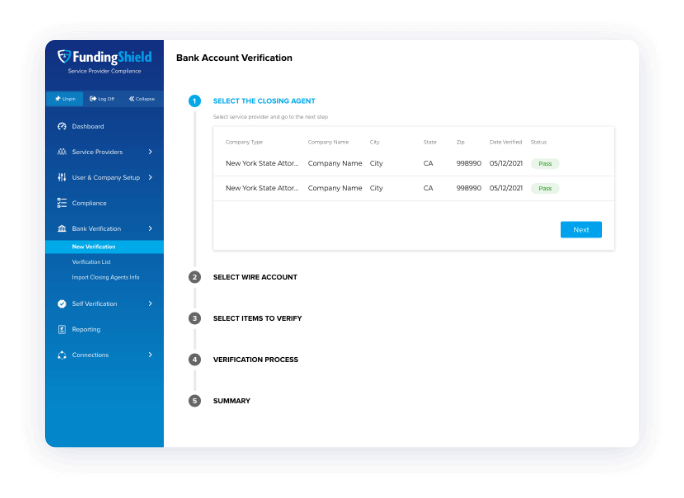

A loan closing transaction level monitoring system that provides a loan level certificate of assurance confirming good settlement, valid CPL coverage, wire account confirmation (using our WAVs system), approved and authorized closing parties, licensing of agents and more on every closing.

Full Visibility and Coverage

Effective transaction Level Controls / Risk Management to prevent wire and title fraud losses

Protection against cyber interference / Business email compromise during the closing process

Increased Efficiency

that lowers costs

Certified products that provide transaction level protection of up to $5mm per transaction

FundingShield offers a unique transaction level service that certifies on each closing several factors allowing lenders to have full visibility and coverage from a:

- Compliance perspective (licensing, insurance, active agency approvals on every closing versus some interval and reliance on out of date databases or vendors who provide a database of latent non transaction based information).

- Risk management perspective (transaction level document verification for uncovered actions, documents, wire accounts)

- Wire fraud prevention strategy leveraging our WAVs system.

MISMO Certified Wire

Fraud Prevention Tool

2020 CFO Tech Outlook Top 10

Financial Security Award Recipient

2020 HousingWire

Tech 100 Award Recipient

Guardian Service

On every loan, we give actionable intelligence and a “fund” or “don’t fund” decision versus others who give you a risk rating to interpret. The results help our clients save time and resources, have closing/funding/control/treasury operations teams that are empowered with an industry-leading partner, and are able to save time and money.

The Trusted Solution Against Mortgage Fraud

Protect your mortgage closing transactions with an all encompassing verification from FundingShield