FundingShield - Q3 - 2024 - Fraud Analytics With Commentary From FundingShield’s CEO Ike Suri

Q3 2024 REPORT

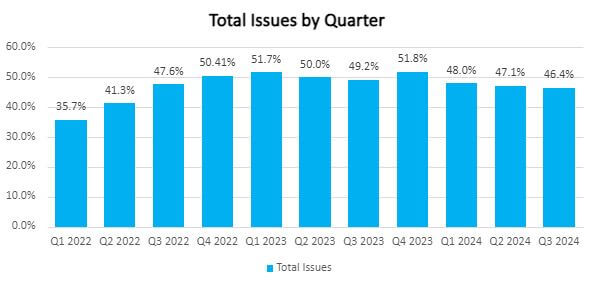

Quarterly Data

During Q3 2024 46.43% percent of transactions on a $82bn portfolio comprising of residential, commercial and business purpose loans had issues leading to a risk of wire & title fraud. On average, problematic loans had 2.23 issues per loan indicating the lack of appropriate controls by closing agents and lenders to identify and fix issues.

Q3 2024 saw record-high risk levels for CPL related errors (45.1% of transactions) for critical data points such as borrower information, vesting / vested parties, non-borrowing parties on title, property addresses, borrower information and more. This is another example of a lack of accuracy between lender and title systems alongside the CPL validation issues where 9.6% of transactions also had issues during Q3.

There were wire related errors at 8.1% of transactions in Q3, the 4th straight quarter with over 8% for this category. License issues grew by 24% from Q2 to Q3 2024 as we see more entities having lapsed, terminated, or suspended licenses and inconsistent data when verified with registrars, insurance regulators and licensing bodies. These persistently high levels highlight the need for source data verification in workflows and for trusted data sets being used as part of critical processes.

AT&T reported that hackers stole 73 million customers’ data including social security numbers, account information, payment details, call and communication history. This type of data provides valuable information to bad actors to leverage as part of social engineered identities in fraud schemes making detection much more difficult.

Controlling data sources, maintaining data accuracy and a process to validate data is paramount in the mortgage and real estate finance industry. This is central to the success of the current and ongoing digital transformation of all aspects of the process. AI based solutions present a great opportunity for automation, collaboration and process improvement, yielding better customer experience and pricing. These benefits cannot be achieved without accurate data sets and real time data verification leveraging live repositories, which is the epicenter of responsible and efficient automation and AI initiatives. We look forward to many more partnerships and mandates built on this ethos.

Analytics Q3 2024 vs Q2 2024:

- Q3 had a new record for number of issues found per transaction at 2.23

- CPL related issues had yet another new record level of 45.1% of transactions.

- 8.1% of transactions had wire related issues the 4th quarter in a row above 8%

- 24% increase in license related issues since last quarter

- CPL Validations, agent good standing, issuance limits and title file order registration issues in title insurance systems remained near the all-time high level of 9.6% for Q3 2024.

Contact Sales@fundingshield.com for more information.