FundingShield - Q2 - 2024 - Fraud Analytics With Commentary From FundingShield’s CEO Ike Suri

Q2 2024 REPORT

Quarterly Data

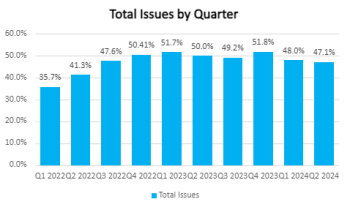

During Q2 2024 47% percent of transactions on a $74bn portfolio comprising of residential, commercial and business purpose loans, had issues leading to a risk of wire & title fraud. On average, problematic loans had 2.21 issues per loan indicating the lack of appropriate controls by closing agents and lenders to identify and fix issues.

Q2 2024 saw near record-high risk levels for wire data and CPL validations. The validations cover critical areas like agent good standing, data accuracy between lenders and title systems, and agent registration/active status, and there has been a 45% growth rate in CPL Validations Q2 23 to Q2 24.

Other data elements showed a slight decline to near flat levels, however we did see a large increase in wire issues quarter over quarter in attorney closing states (unauthorized practice of law “UPL states” ). The growth rate in errors across all states from Q2 2023 to Q2 2024 was 26%, and UPL states saw a 90% increase in errors during the same period last year.

CPL issues were found on 45.04% of transactions, CPL Validation issues remained at 9.8% of transactions and Wire risks on 8.8% of transactions. These persistently high levels highlight the ability for bad actors to successfully gain knowledge of mortgage and real estate closings and then attempt to use spear phishing, Business Email Compromise attacks or other means to divert funds going to and out of escrows / settlement accounts.

Analytics Q2 2024 vs Q1 2024:

- ~1.2% decrease in the number of errors found among loans with issues

- 1.1% increase in CPL related issues to the new record level of 45.04% of transactions.

- 8.8% of transactions had wire related issues staying at near the all-time high rate that was reached during Q1 2024.

- 78.48% increase in license related issues since last quarter

- CPL Validations, agent good standing, issuance limits and title file order registration issues in title insurer systems remained near the all-time high level of 9.8% for Q12024.

Contact Sales@fundingshield.com for more information.