FundingShield – Q1 – 2024 – Fraud Analytics

Q1 2024 REPORT

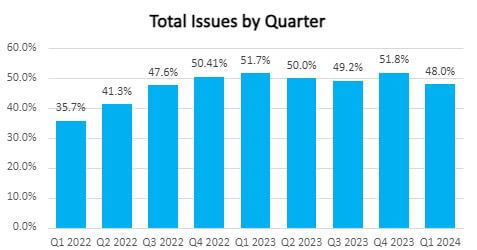

Despite a slight decline from the record-breaking Q4 2023, wire and title fraud risk in Q1 2024 remained concerningly high. Nearly half (48.0%) of loans processed in Q1 still exhibited at least one risk factor.

Quarterly Data

During Q1 2024 48% percent of transactions on a $65bn portfolio compromising of residential, commercial and business purpose loans, had issues leading to a risk of wire & title fraud. On average, problematic loans had 2.22 issues per loan indicating the lack of appropriate controls by closing agents and lenders to identify and fix issues.

Q1 saw record-high risk levels for wire data and CPL validations. These validations cover critical areas like agent good standing, data accuracy between lenders and title systems, and agent registration/active status. While other data elements showed a slight decline, this is likely due to seasonal trends related to title agent license and insurance renewals.

CPL issues were found on 44.6% of transactions, CPL Validation issues at 9.8% of transactions and Wire risks on 9.2% of transactions. This increase highlights the ability for bad actors to successfully gain knowledge of mortgage and real estate closings and then attempt to use spear phishing, Business Email Compromise attacks or other means to divert funds going to and out of escrows / settlement accounts. Additionally, FaaS (fraud as a service) has an ongoing impact such as the Citrix Bleed and other cyber-attacks at Fidelity, First American and numerous other lenders. This has created the perfect storm for social engineering attempts by bad actors to impersonate closing agents and reroute funds.

Analytics Q1 2024 vs Q4 2023:

- ~4.5% decrease in the number of errors found among loans with issues as compared to Q4 2023

- 9.5% increase in CPL related issues since last quarter where high levels were touched.

- 8.9% increase in Wire related issues since last quarter hitting a new all-time high rate.

- 7.43% increase in license related issues since last quarter

- CPL Validations, agent good standing, issuance limits or title file order registered in title insurer systems had a 29.32% increase Q12024 vs Q42023 hitting all time highs.

Increasing Fraud and Cyber Security Risk in the Market:

Q1 continued to have numerous data leaks and ransomware attacks on Bank and Nonbank lenders including the likes of Bank of America whose Technology Solutions Vendor suffered a data leak of Bank of America Customers. This underscored the importance of regulated entities to understand what type of ongoing monitoring they have for vendor and third-party service providers where there may not be an ongoing relationship.

Ike Suri shared, “At a recent CEO roundtable where FundingShield presented to Bank and IMB CEOs of mortgage companies or mortgage lending units within banks, 60%+ of the CEOs said they had been informed of increased threat activity or attempts by bad actors to hack into their system during Q1 where bank and wire information is stored ahead of or during funding. Nearly 50% spoke with FundingShield seeking wire and title fraud prevention solutions to address the current market risk.”

FBI IC3 Reporting on Cyber Crime:

The FBI IC3 Report for 2023 showed $2.9 Billion in reported losses related to business email compromise which was 2nd highest category for cybercrime losses. 2023 had a record high of 880,418 complaints to the FBI, with potential reported losses exceeding $12.5 billion. This is nearly a 10% increase in complaints, and represents a 22% increase in losses, compared to 2022. Further the FBI data captures only data reported to them for which the agency will pursue and where they have validated the claimed loss or theft thus the actual number is much higher.

Ike Suri commented, “Q1 was a period where we saw some market improvements and volumes increasing as the winter lull thawed. The lenders that have prepared for the market improvements, including some of our new clients, have tech tools for their risk & compliance, operations, funding & accounting teams to fight back against threats. Communication gaps, lack of validation, non-existent verification processes, and system deficiencies created numerous vulnerable endpoints allowing wire and title fraud risk to grow to all high time for lenders today.”

FundingShield noticed a higher risk concentration in “Attorney Only” close states where the handling of title and settlement work is considered a legal product requiring active status and good standing with state bar associations. In these states, referred to as the unauthorized practice of law (UPL) states, we saw a higher rate of risk for CPL Validation risk with 13.2% of transactions having errors. We also saw a higher rate of insurance coverage issues in UPL states at 2.2% or 60% higher than non UPL states.

FundingShield was able to help provide clients with customized workflow solutions and a precise view into the risk at the loan level for impacted transactions. This enabled clients to make better funding and closing decisions in real time leveraging live data versus other approaches focused on providing risk reports confirming permissions to licensing or authority based on stale information.

Our live, plug and play, malleable and scalable solutions are built into milestones for closing and funding allowing for a consistent framework for risk management on every transaction. Recent integrations with SitusAMC and Corelogic have added to Fundingshield LOS and partnership integrations ensuring further controls and tracking is conducted to securely verify the title and escrow parties a lender will work with.

Ike Suri shared, “The escalating conflict in the Middle East, the upcoming US Elections and an inflationary market create challenging times for the mortgage industry. AI driven tools allow bad actors to easily and believably deploy attacks that look legitimate on the face of correspondence taking advantage of the challenges that Geopolitical events can cause as one of many approaches used. We expect there will be more attacks exploiting known and new vulnerabilities among homebuyers, lenders and title agents as the closing process has many players with different level of controls where B2B2C consumer facing solutions are being utilized.”

Contact Sales@fundingshield.com for more information.