FundingShield Q2 2023 Fraud Analytics

Commentary from FundingShield’s CEO Ike Suri:

Q2 2023 REPORT

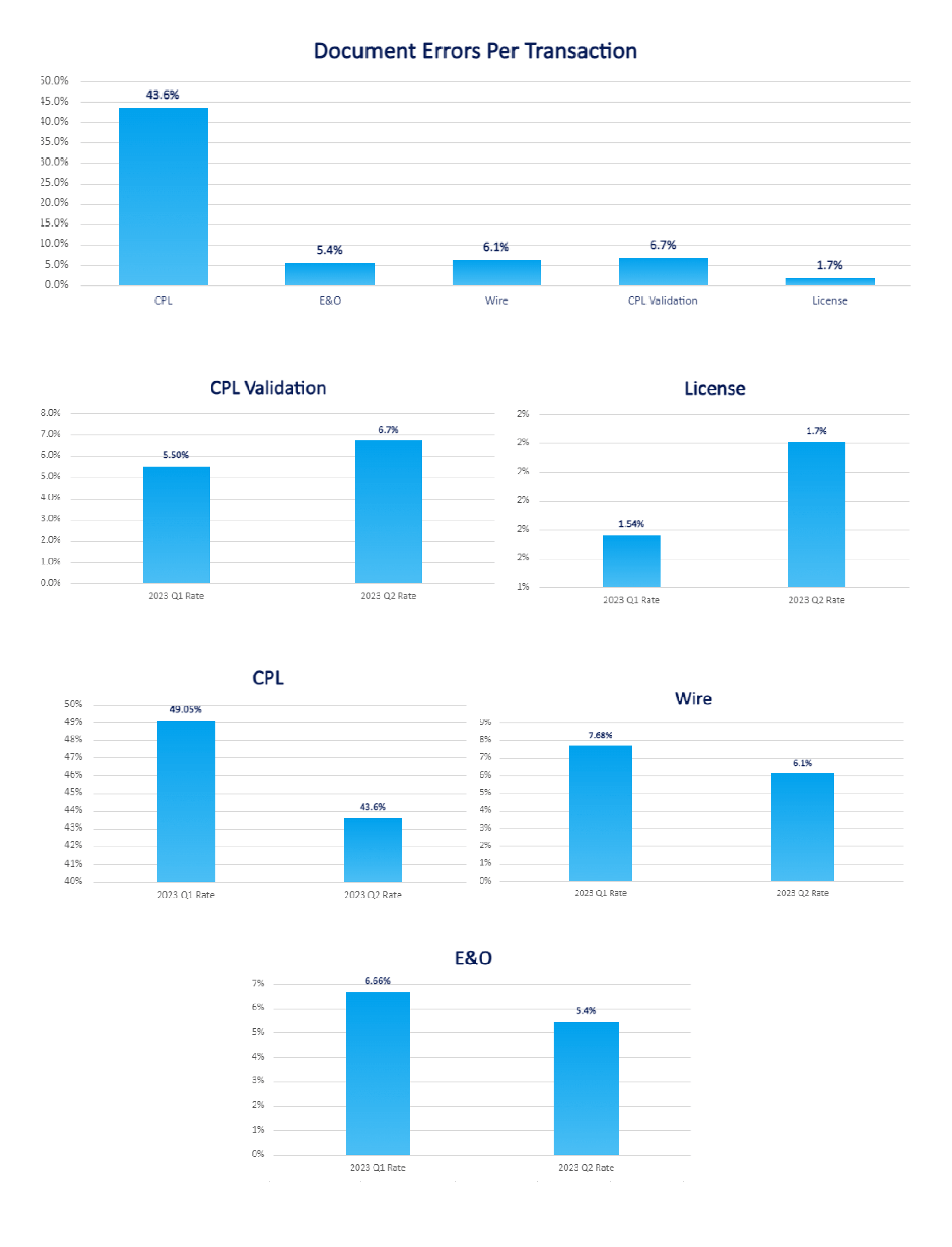

Wire and title fraud continue to persist at alarming highs in 2023. With 50.2% of loans in Q2 of 2023 having at least one risk issue, it’s evident that the risk of a fraud event has gone up despite stagnant or declining volumes compared to 2022.

Quarterly Data

During Q2-2023 50.2% percent of transactions on a $68bn portfolio had issues leading to a risk of wire & title fraud. On average, problematic loans had almost 2 issues per loan indicating the lack of appropriate controls by closing agents to identify and fix issues.

Further, Q2 yielded an all-time high for agent licensing/good-standing issues. With a 15% change compared to Q1, more agents are failing to keep their licenses active with states and insurance commissioners. 6.7% of agents also sent lenders a CPL that wasn’t registered in title insurer systems or had incorrect data compared to what the insurers had on file at the time of closing. This is a significant 22% uptick compared to last quarter highlighting the disjointed nature of data/document transfers between agents, title insurers, and lenders. Our $5mm per transaction coverage, the only offering of its type in the market, is a key driver to addressing the increased risk that lenders face today.

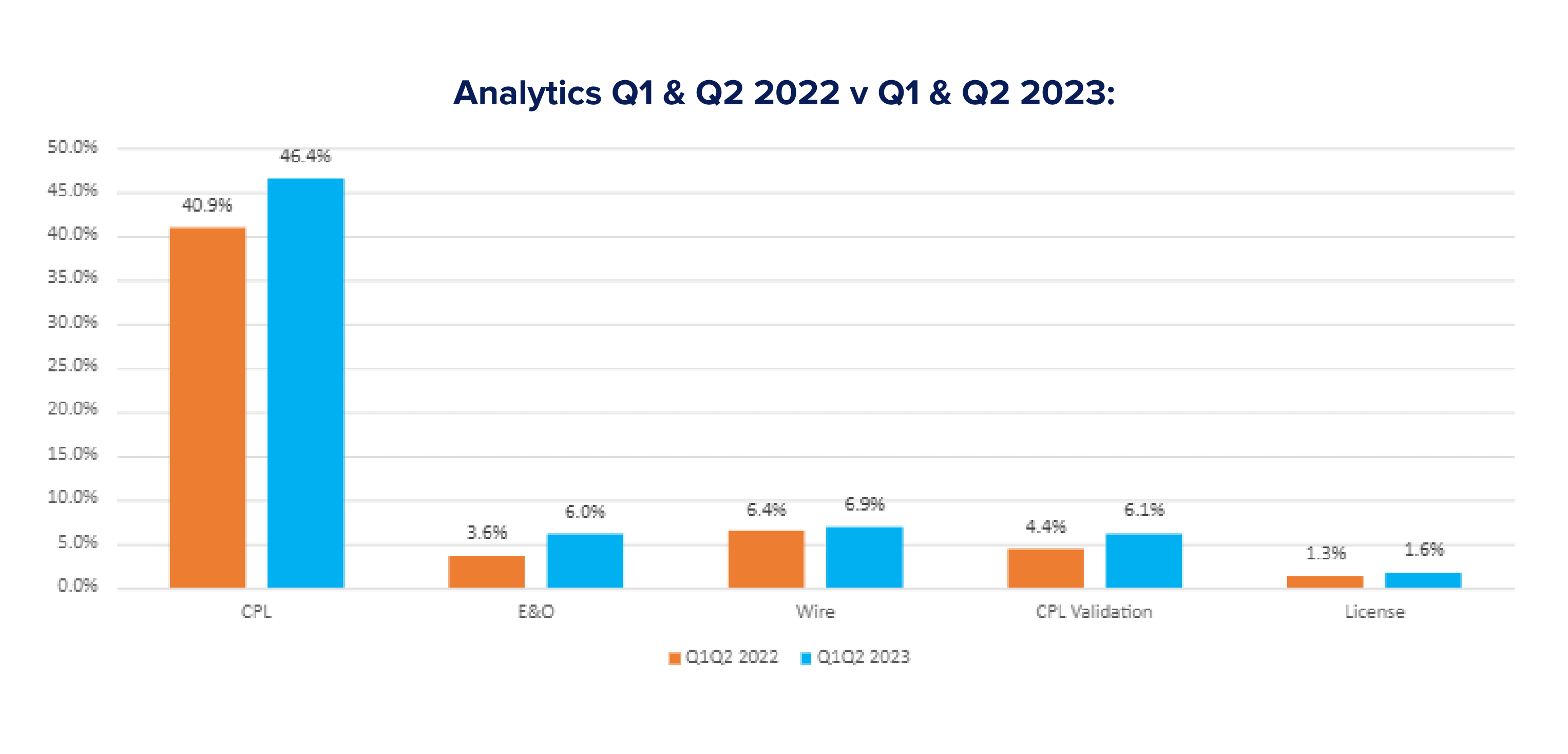

Analytics Q1 & Q2 2022 v Q1 & Q2 2023:

- 12.6% increase in the number of loans with issues in the first half of 2023 compared to the first half of 2022.

- 6.5% increase in CPL related errors including data mismatches that lead to additional work post-closing.

- 4.7% increase in issues with proof of insurance including E&Os and Commercial Crimes policies.

Increasing Fraud in the Market

Business email compromise continues to be one of the fastest and most effective ways that fraudsters scam parties in a real estate transaction. Per the Federal Bureau of Investigation, business email compromise scams related to real estate set a record for dollar losses in 2022, as the number of cases reported to the FBI rose for the second consecutive year. FundingShield’s CEO, Ike Suri, opines that the FBI’s report of $10.3B in fraud losses is being grossly underreported based on our experience identifying, preventing, and remediating issues in real-time.

FundingShield prevented yet another business email compromise attack hours before the 4th of July holiday this year. A title company’s email systems were compromised, and a bad actor sent fraudulent wire instructions from the title officer’s email to all parties in a transaction. Our bank data/document review quickly identified the documents as fraudulent, and we notified all parties to halt any outgoing wires to the title company. The lender, buyer, and seller were protected from losing almost $400,000.00 to a bad actor.

New Product Launch

FundingShield’s newest product, PaymentShield launched in Q2 2023, in partnership with Mastercard. PaymentShield is an industry-agnostic payment verification tool that verifies any depositor’s banking information directly with their financial institution.

Ike Suri shared that “FundingShield has over 95% coverage of licensed service providers in the mortgage closing and settlement space in our live repository. This partnership with Mastercard allows us to leverage its open banking connectivity of over 95% of U.S. based deposit accounts for consumer-permissioned access to real-time, bank-sourced data – to expand our B2B and B2B2C payment verification solutions for clients.”

This expansion of FundingShield’s services addresses challenges that many market participants have been facing when trying to authenticate outgoing funds, such as to vendors, home sellers, suppliers, or other funds recipients in the broader financial services industry.